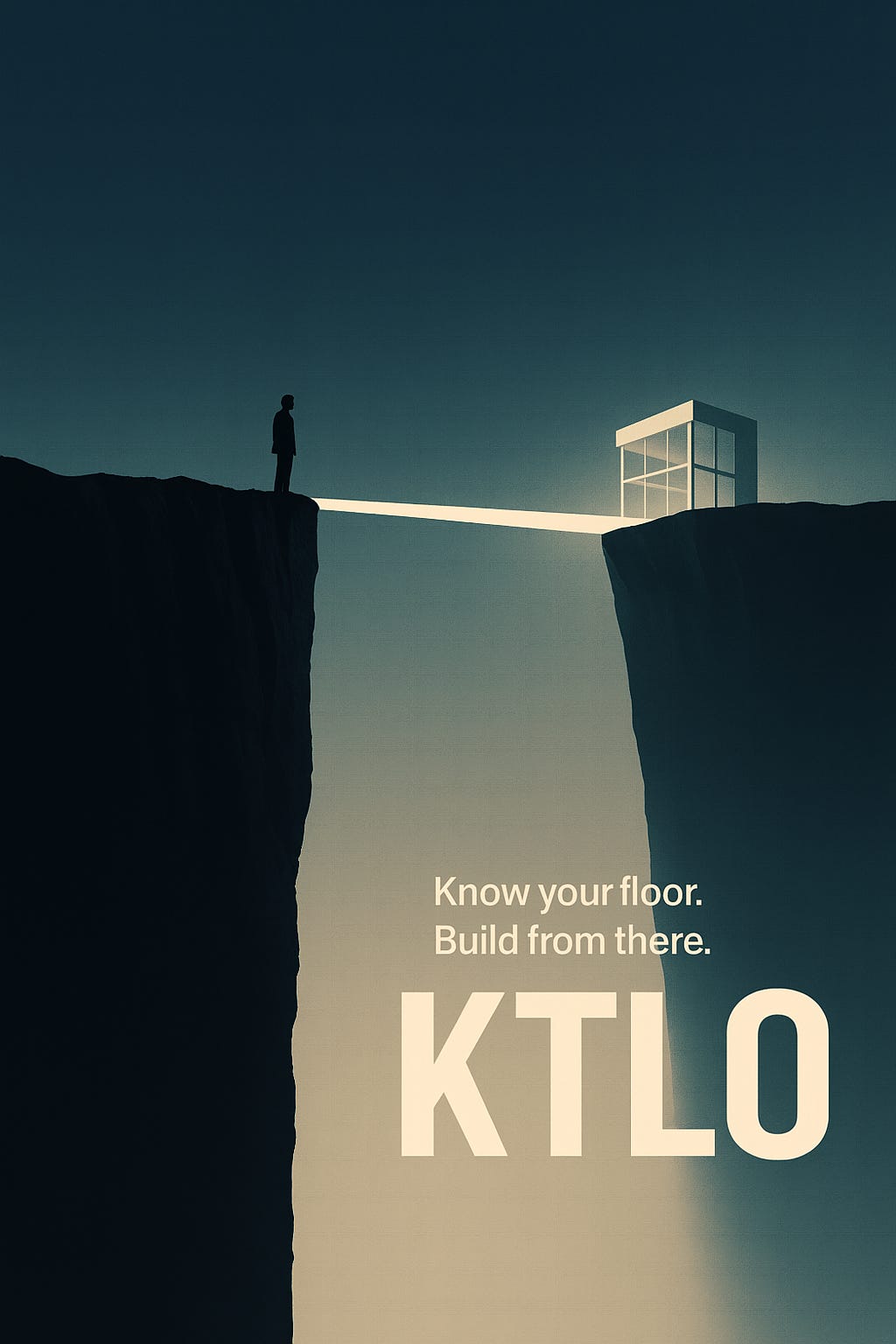

KTLO: The Founder Floor

What it really costs to keep going, and how to build from clarity instead of chaos.

I’ve had more conversations than I can count with founders holding it together by a thread.

Founders negotiating with panic attacks in private, carrying the weight of payroll, mortgage payments, and investor updates while trying to protect their team and explain to their family why their life savings are tied up in a dream with no guarantee of return.

The anxiety is crushing. The pressure is unrelenting. The consequences are personal.

Every founder deserves a clear operating system for survival - before the vision takes flight, before the raise lands, before the pitch deck converts.

KTLO is that system. A foundational element of our Growth by Design we employ for our portfolio companies at GetFresh Ventures.

Keep The Lights On is more than a budgeting tool. It is your baseline operating framework. It defines what it costs to stay alive as a business and as a person. It shows you what’s required to fulfill your obligations, preserve your energy, and control the dials of your company before you ever try to scale it.

Whether you're a SaaS founder chasing product-market fit with four months of cash left in the bank, or a service business operator trying to launch a product without cannibalizing your income, KTLO gives you the clarity to act with precision.

It tells you the truth about what your company needs to keep running.

It protects you from becoming the founder who dips into personal savings, leverages home equity, or delays personal pay for the sake of keeping the illusion of growth alive - without knowing when the next dollar arrives.

KTLO forces a moment of discipline:

Can you serve current customers for the next six months?

Can you pay yourself enough to survive?

Can you meet payroll without begging the bank or crossing your fingers for a term sheet?

It answers these questions with math, not stress. It gives you a model to build forward from, not backwards into. It creates the foundation from which you can understand:

Your floor for solvency

Your fixed costs vs. scale investments

Your burn rate and survival runway

Your control levers across product, sales, marketing, and delivery

Founders who build with KTLO understand exactly where the friction sits. They see which functions are driving revenue and which are draining cash. They learn how to scale operations without compromising delivery. They become sharper, faster, and calmer - because the unknown becomes knowable.

KTLO doesn’t ask for your optimism. It gives you power.

Power to stay alive long enough to win.

Power to negotiate with investors from a place of strength.

Power to lead your team without hiding financial truths.

KTLO gives you a business you can control, and a life you can still live.

What follows is a full breakdown of how to build that system, use it, and integrate it into your operating rhythm as a founder. You’ll learn how to define your floor, model your cash, isolate your levers, and scale with confidence.

KTLO is the operating framework every founder should master before they ever chase growth.

Part I: What KTLO Really Means for Founders

Every founder reaches a moment when the pressure becomes hard to ignore.

Cash is tight. Revenue is inconsistent. Investors are unresponsive. Team expenses are growing faster than the confidence in future sales. These moments are not indicators of failure. They are milestones in the lived experience of building a company from zero.

In these moments, clarity becomes more valuable than speed.

KTLO exists for that exact purpose.

KTLO represents the minimum financial structure required to preserve delivery, honor obligations, pay yourself enough to live, and keep the company solvent—without depending on net new revenue or investor funding.

The KTLO budget is more than a burn calculator. It is a mindset and operating system that gives founders a precise understanding of the financial floor beneath their business. It defines how long the company can survive with the current cash and contractually guaranteed revenue. It isolates what truly matters: serving customers, paying essential team members, maintaining infrastructure, and ensuring legal and financial compliance.

KTLO does not measure growth ambition. It protects your survival.

It is a tool that answers this foundational question:

“If we closed no new sales tomorrow, how long could we continue delivering on our existing promises—without sacrificing integrity, burning out, or becoming legally exposed?”

That question becomes the center of strategic planning when the economy turns, a raise falls through, or growth experiments take longer than expected to land.

KTLO gives founders the ability to breathe. It provides a structure to pause, assess, and make grounded decisions. With a clear KTLO model in place, founders can plan layoffs without panic, negotiate investment on their own terms, and invest in growth when the timing is right—without gambling the company’s solvency.

The KTLO model is not tied to stage, industry, or funding model. It serves early-stage SaaS founders with $10K MRR and post-Series A startups with unpredictable churn patterns. It serves bootstrapped e-Commerce operators and angel-backed services businesses scaling toward productization.

KTLO is the first budget you build when you want to understand what keeps your business alive.

Once it’s built, everything else sits on top.

Part II: Founder's Lens — How KTLO Reframes Pressure Into Power

Founders carry invisible weight. Behind every pitch, sprint, and daily standup sits a private storm of financial calculations, emotional volatility, and existential questions about whether the company is stable, viable, or about to unravel.

That internal load creates drift. Decision quality begins to erode. Some days feel productive. Others feel reactive. Tasks pile up. Hiring becomes uncertain. Budgeting feels like guesswork. The mind keeps circling back to the same question:

“Can we keep going?”

KTLO provides a direct answer.

It converts existential pressure into structured knowledge. It grounds fear in math. It shifts the founder’s emotional energy from survival panic to intentional planning.

A founder with a KTLO model knows:

The exact monthly cost to deliver the current product to paying customers

The minimum team required to fulfill those obligations

The true burn rate required to stay in business

The number of months they can operate without additional capital or new sales

This knowledge transforms posture.

Founders gain the ability to:

Push back on premature scale hires

Renegotiate investment terms without panic

Delay aggressive expansion until conversion data supports it

Communicate with teams using concrete, solvency-backed plans

KTLO removes the fog that fuels indecision. It creates emotional stability by giving the founder something real to hold onto when forecasts become fiction. It becomes the first tool to consult before adding a role, testing a channel, or reforecasting a plan.

Founders who live through downturns, missed raises, or pivot cycles learn that longevity depends on how early they build KTLO clarity. The earlier the floor is defined, the more confidently they build the next layer of their company.

KTLO gives founders language, data, and control. It does not remove all risk. It gives the founder the power to allocate risk precisely—on their own terms, with full visibility of the downside and full agency over their next move.

Part III: Baseline Design — The Core Components of a KTLO Budget

The KTLO budget begins with a simple idea: design a financial model that sustains the company’s operations without relying on new sales or investment. This model provides a fully self-contained view of what it costs to keep the company solvent, customers supported, and operations intact under minimal viable conditions.

Every KTLO budget contains three foundational elements:

Cash-in-hand and committed revenue

Essential monthly operating expenses

Runway calculation based on current burn

The purpose of this model is to isolate the business’s lowest viable configuration. It does this by removing assumptions and dependencies that rely on external momentum or short-term upside.

3.1 Cash-in-Hand and Committed Revenue

The first input is the total capital available to the company without speculation. This includes:

Liquid cash available in the company’s bank accounts

Uninvoiced revenue from signed contracts that are guaranteed to pay out

Pending government reimbursements with secured and approved schedules (e.g., IRAP, SR&ED)

Pipeline deals, MOU agreements, and non-binding letters of intent are excluded. The KTLO model assumes zero net-new income beyond existing contractual guarantees.

3.2 Essential Monthly Operating Expenses

KTLO defines a minimum viable state. It includes only the costs required to fulfill the company’s existing obligations. These fall into six categories:

a. Minimum Viable Payroll

Founder compensation at livability level (defined by actual personal survival requirements)

Salaries for delivery-critical team members (product, support, infrastructure)

Employer contributions (taxes, benefits, insurance, etc.)

All additional headcount tied to future growth, sales expansion, marketing experimentation, or team “optics” is excluded.

b. Core Infrastructure

Cloud infrastructure required to run the product

Essential software licenses (e.g., billing, authentication, CRM, email systems)

Security, monitoring, and uptime tools

Only systems that are required for delivering the product or maintaining data integrity are retained.

c. Compliance and Finance

Bookkeeping, payroll software, tax compliance, and basic accounting

Legal retainers or required filings

Insurance premiums

This ensures the business remains operationally compliant and protected from liability.

d. Customer Fulfillment and Support

Hosting or bandwidth required to serve active customers

Tier 1 support infrastructure

SLA commitments tied to contracts

Fulfillment costs should map directly to existing customer obligations. Any tools or vendors used for future onboarding or pipeline acceleration are excluded.

e. Office and Remote Work Essentials

Workspace costs only if tied to active operations (not branding or founder preference)

Connectivity or home office stipends that directly enable delivery

Founders should assess these costs critically to determine whether they are essential to survival or cultural overhead.

f. Debt and Contractual Obligations

Minimum payments on loans, credit facilities, or revenue-based financing

Any costs with fixed penalty structures (e.g., breakage fees, equipment leases)

These are included because failure to service them directly impacts the business’s ability to continue operating legally.

3.3 Runway Calculation

Once total KTLO monthly burn is calculated, runway is computed using the following formula:

KTLO Runway (Months) = Total Available Capital ÷ KTLO Monthly Burn

This figure becomes the founder’s financial floor. It tells the exact number of months the company can remain solvent while continuing to serve customers and retain essential operations, with no additional revenue or capital.

This calculation should be updated monthly, tracked in dashboards, and included in any operating review rhythm that governs capital planning, hiring, or fundraising strategy.

Part IV: Application — Building and Living Your KTLO Budget

Building a KTLO budget is an exercise in clarity. Living by it is a discipline in focus. When founders treat KTLO as a living system within their business, it becomes an operational rhythm that reduces noise, increases control, and strengthens financial judgment.

The transition from spreadsheet to system requires intentional design. Each component must integrate into the company’s planning cadence, hiring strategy, and decision-making routines. KTLO becomes useful when it becomes visible.

4.1 Building Your KTLO Budget: Step-by-Step

Step 1: Open a Clean Workbook

Begin with a blank spreadsheet. Label three sections clearly:

Cash & Committed Capital

Monthly KTLO Burn

Runway & Risk Window

This model becomes your working surface for financial control.

Step 2: Input All Available Capital

Enter your:

Current cash balance from bank statements

Unpaid invoices with contractual certainty

Grant or credit disbursements with confirmed milestones

This total becomes your KTLO cash foundation.

Step 3: Map Essential Expenses

Create detailed line items under five primary categories:

Payroll and team costs (at survival-level comp)

Cloud infrastructure and software essential for delivery

Accounting, legal, insurance, and compliance costs

Support and fulfillment tools tied to current customer obligations

Loan servicing and fixed obligations

Exclude all growth-stage expenditures. The KTLO model answers for the business in its base survival configuration.

Step 4: Validate Monthly Burn

Sum all KTLO-eligible expenses to define your monthly base burn. Review each category and apply a confidence score from 1 to 3:

3 = mission-critical

2 = valuable but deferrable

1 = optional within a 60-day horizon

This allows quick identification of flexibility within the model.

Step 5: Calculate Runway

Divide total available capital by validated monthly KTLO burn.

For example:

Capital: $220,000

KTLO Burn: $18,000/month

Runway = 12.2 months

This output becomes the operational compass for planning, hiring, and capital strategy.

4.2 Living the Budget: Operating Routines

KTLO only delivers value when revisited regularly and embedded into founder rhythms. The following practices reinforce the discipline:

Monthly Budget Reviews

Recalculate KTLO burn at the start of every month. Update actuals against budgeted figures. Identify any variances and assess which categories need reclassification.

Hiring Checks

Before extending an offer, ask:

“Is this role in the KTLO plan or the Growth Plan?”

This single question prevents reactive hires and enables resourced growth.

Decision Filters

Apply a KTLO filter to all spend over $1,000. Label the spend as either:

Required for current delivery

Designed for new revenue generation

Non-critical and deferrable

Categorizing spend by function ensures capital allocation aligns with solvency goals.

Board and Team Visibility

Include KTLO runway metrics in board updates, team planning sessions, and capital raise memos. This builds investor confidence and aligns internal stakeholders around cash integrity.

KTLO builds operating rhythm by creating a shared language for survival. It centers the team on execution that sustains delivery and extends control.

Part V: Strategic Extension — How KTLO Supports Confident Growth

Once a KTLO budget is built and operationalized, it becomes more than a floor. It becomes the foundation for building structured growth. Founders who understand their KTLO position can take calculated risks, deploy capital with purpose, and design hiring plans that create leverage without shortening their runway unnecessarily.

Growth becomes less reactive and more intentional when layered above a clear survival system. The KTLO model defines what is fixed. The Growth Budget defines what is flexible.

5.1 Staging Growth on Top of KTLO

The Growth Budget is a separate model that sits above KTLO. It represents capital allocated toward expanding revenue, accelerating acquisition, or building infrastructure that enables new capabilities.

Key components include:

Go-to-Market Investment

Outbound sales capacity, partner programs, marketing campaigns, and paid acquisition strategies that aim to grow top-line revenue.Product Development for New Markets

Engineering hires and R&D sprints directed at building new capabilities, features, or verticals beyond the current book of business.Customer Success Expansion

Investments in onboarding, success, or support resources designed to increase retention, reduce churn, or expand net revenue from current accounts.Finance and Capital Structure Projects

Advisory or fractional support focused on preparing for future raises, equity planning, or scenario modeling beyond current obligations.

Each line in the Growth Budget carries a hypothesis:

“If we spend $X here, we expect $Y in measurable impact over Z months.”

This gives founders a way to tie spend to outcomes and evaluate progress on a fixed cadence.

5.2 KTLO as Risk Management

When founders understand the clear separation between KTLO and growth investments, they gain the ability to:

Scale back from the Growth Budget without damaging existing delivery

Preserve solvency during unexpected revenue slowdowns

Delay or cancel initiatives that do not return value within the defined window

Evaluate fundraising needs based on growth strategy, not survival pressure

Growth plans can now be modeled with scenario-specific cash forecasts:

Conservative case: Run at KTLO for 12–18 months

Base case: Layer incremental growth investments with 9–12 month payoff

Aggressive case: Full growth execution with clear CAC and LTV benchmarks

Each scenario keeps the KTLO budget intact. This allows the founder to adjust tactics without jeopardizing the company’s operating core.

5.3 Scaling with Confidence

With KTLO clarity, founders can:

Add team members knowing how it impacts both survival and acceleration

Choose to invest in acquisition channels that outperform base churn

Defer experiments that lack line-of-sight ROI

Structure raises based on opportunity, not urgency

This alignment builds investor trust. It gives teams clear swim lanes. It enables longer-term planning without overcommitting resources or compressing runway.

Founders who operate above their KTLO floor with this level of control show up as disciplined, capital-efficient, and focused on compounding value.

Part VI: Founder Clarity — How KTLO Strengthens Decision-Making

The KTLO budget brings more than financial insight. It sharpens a founder’s ability to make high-leverage decisions. With a clear understanding of minimum burn and available runway, founders unlock a new level of strategic clarity. Decisions that once felt murky become anchored in grounded numbers and clear boundaries.

This clarity reinforces leadership discipline, strengthens capital stewardship, and sharpens the lens through which every opportunity or risk is evaluated.

6.1 Capital Planning with Precision

Founders who operate with a clear KTLO model can evaluate capital needs with more accuracy. They know exactly how much time they’re buying with each raise. They can model how hiring, churn, or pricing adjustments affect solvency in real time. They can delay or stage capital deployments based on observed revenue expansion.

Instead of targeting round sizes based on peer benchmarks or investor expectations, they determine:

What they need to preserve their floor

What they want to layer in for upside

How long each path preserves founder control and optionality

This approach improves conversations with current and future investors. It reduces over-raising. It keeps founders in control of dilution and timeline.

6.2 Role Clarity and Team Focus

Every team experiences pressure to grow headcount, launch new experiments, or invest in systems to look “enterprise-ready.” The KTLO model gives founders a way to filter these choices through a survival lens.

When the team knows what’s required to preserve the core, it creates alignment around:

What roles are foundational to delivery

Which tools are required for day-to-day operations

Where the line sits between critical work and experimental work

This clarity eliminates internal confusion about hiring plans, budgeting timelines, and team prioritization. It becomes easier to communicate trade-offs, set expectations, and explain why certain investments are staged rather than rushed.

6.3 Strategic Focus and Tradeoff Management

With KTLO data in hand, founders ask better questions:

What would I pause first if I had to extend runway?

Which investments return revenue within 90 days?

What experiments am I running without a defined success threshold?

Which systems would still function if I disappeared for two weeks?

Each of these questions generates focused dialogue and better prioritization. When decisions become hard, KTLO provides a clarity anchor. It reframes ambiguity into structure. It removes indecision from the founder’s mental loop.

6.4 Confidence During External Volatility

Markets shift. Investors pull back. Customers delay decisions. These external forces create instability in traditional planning models. KTLO operates independently of external optimism. It centers the business around internal solvency.

This provides calm during funding delays, failed pilots, or downturns. It helps founders remain level-headed, reduce reactive thinking, and keep the team aligned without fear-based decision spirals.

A founder with KTLO in place walks into board meetings, investor calls, and team reviews with a clear, validated view of what matters most.

Part VII: Long-Term Durability — KTLO as a Repeatable Survival System

KTLO begins as a tool for early-stage survival. It evolves into a permanent operating mechanism for long-term durability. Founders who integrate KTLO into their financial architecture early discover its enduring utility. It continues to serve through growth cycles, market changes, and investor milestones. It becomes part of how the company interprets risk, plans expansion, and protects its core mission.

KTLO does not expire with scale. It adapts with it.

7.1 From Early-Stage Lifeline to Mid-Stage Stability

In the earliest stages, KTLO clarifies what it takes to survive. As the business matures, KTLO evolves to support:

Product line diversification

Team structure complexity

Multi-market operations

Recurring customer fulfillment across geographies

The underlying method remains the same:

Define cash on hand and committed revenue

Model essential delivery costs

Calculate minimum monthly burn

Map survival runway

What changes is the scope. Instead of modeling one product line, the founder models across business units. Instead of a single founder salary, the company models executive coverage and cross-functional retention.

The principles remain durable. The structure scales with the business.

7.2 Integration into Company Operating System

Mature companies incorporate KTLO into their:

Board reporting frameworks

Investor update packages

CFO or FP&A dashboards

Operating reviews and quarterly planning cycles

This ensures the company has visibility on its survival threshold at all times. It avoids overreach. It enables early risk detection. It supports capital allocation decisions with real-time burn and runway intelligence.

Founders gain long-term leverage when KTLO becomes a default lens across the organization.

7.3 Operational Confidence During Scale Challenges

When companies scale, friction increases. Delivery gets more complex. Cash conversion cycles stretch. Headcount grows. Team structures change. Forecasts lose precision. KTLO provides a stable reference point.

It answers:

What is required to maintain base service delivery?

How many months of runway are protected, regardless of new growth?

Which teams contribute to survivability versus expansion?

This enables structured responses during growth hiccups:

Pausing new hires without layoffs

Retrenching into the core product line during a market contraction

Preserving culture and clarity when expansion slows

KTLO becomes the operating floor that supports every growth ceiling.

7.4 Case Examples of KTLO Durability

A SaaS company with seasonal contracts

Used KTLO to preserve operations through a 6-month renewal gap. Delayed non-critical feature launches. Preserved core team and extended runway without layoffs.

A bootstrapped services company launching a product

Built a KTLO model to separate services delivery from product experiments. Enabled cash-positive growth while funding MVP development from surplus, not core cash.

A founder navigating an acquisition

Used KTLO to show the buyer a clear cost-to-service profile. Increased valuation by demonstrating financial control and operating resilience.

Each of these outcomes stems from KTLO’s durability across time, stage, and complexity.

KTLO begins as a survival tool. It becomes a trust mechanism. It evolves into an execution framework. It stays with the founder across the journey.